How to Send Money from Cash App to PayPal: A Comprehensive Guide

In today’s digital age, the ability to seamlessly transfer funds between different platforms is crucial. Two of the most popular platforms for sending and receiving money are Cash App and PayPal. While both offer convenient services, they operate as distinct ecosystems. Many users often wonder, how to send money from Cash App to PayPal? Unfortunately, there isn’t a direct method to transfer funds between these two platforms. This guide will explore the reasons behind this limitation and provide alternative solutions for moving your money.

Understanding the intricacies of financial transactions between platforms like Cash App and PayPal is essential for efficient money management. This article provides a detailed exploration of why a direct transfer isn’t possible and offers practical workarounds to achieve your goal. We’ll delve into the nuances of each platform, offering step-by-step instructions and helpful tips to ensure your money reaches its destination smoothly.

Why Can’t You Directly Transfer Money from Cash App to PayPal?

The primary reason for the lack of direct transfer functionality lies in the competitive nature of these platforms and the proprietary systems they operate on. Cash App and PayPal are direct competitors in the digital payment space. Allowing direct transfers would essentially benefit the rival platform, potentially leading to a loss of users and transaction fees. Furthermore, both platforms have distinct security protocols and risk management systems that are not directly compatible. Integrating these systems would present significant technical and security challenges.

Another factor is the regulatory landscape. Financial transactions are subject to various regulations, and each platform adheres to its own set of compliance standards. Bridging these compliance frameworks would require significant legal and operational adjustments, making a direct integration less feasible.

Alternative Methods to Transfer Funds

While a direct transfer isn’t possible, there are several viable workarounds to send money from Cash App to PayPal. These methods involve using intermediary accounts or services to bridge the gap between the two platforms.

Using a Bank Account as an Intermediary

This is the most common and generally the most straightforward method. It involves linking the same bank account to both your Cash App and PayPal accounts. Here’s a step-by-step guide:

- Link Your Bank Account to Cash App: Open the Cash App and tap the profile icon in the top-right corner. Select “Linked Banks” and follow the prompts to link your bank account.

- Transfer Funds from Cash App to Your Bank Account: On the Cash App home screen, tap the dollar amount. Enter the amount you want to transfer and tap “Cash Out.” Choose your linked bank account and confirm the transfer. Standard transfers are typically free but take 1-3 business days. Instant transfers are available for a fee.

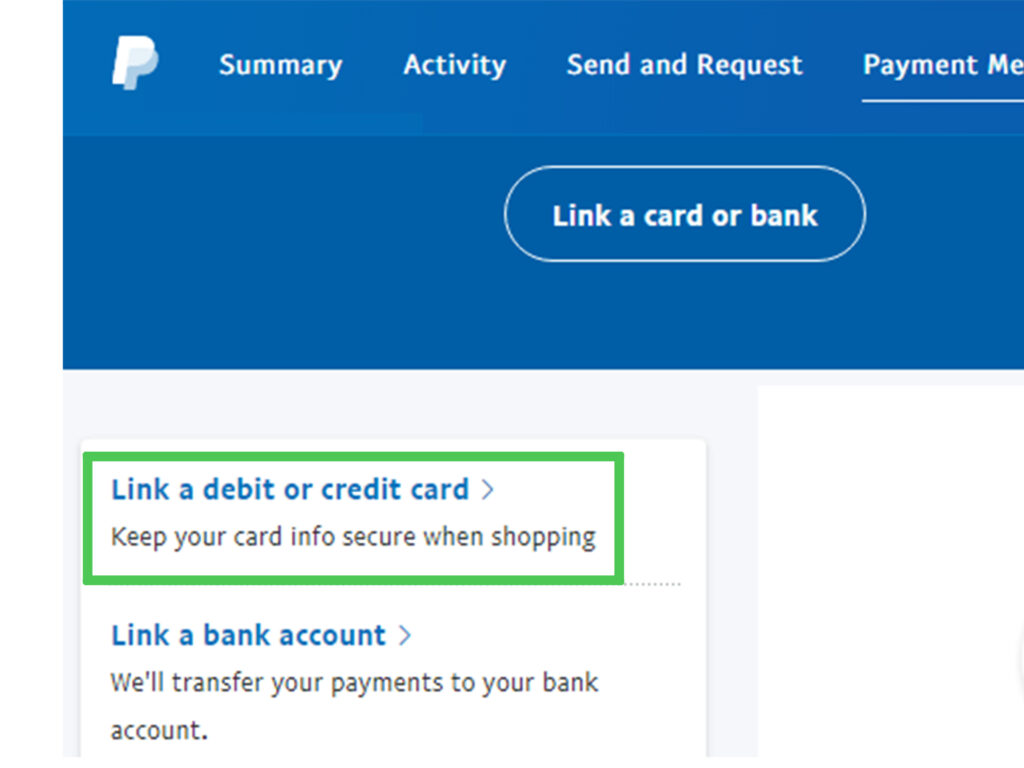

- Link the Same Bank Account to PayPal: Log in to your PayPal account and go to “Wallet.” Click “Link a bank account” and follow the instructions to link the same bank account you used for Cash App.

- Transfer Funds from Your Bank Account to PayPal: Once your bank account is linked to PayPal, go to “Wallet” and click “Transfer Money.” Select “Add money to your balance” and choose your linked bank account. Enter the amount you want to transfer and confirm the transaction.

This method is reliable and generally cost-effective, especially if you opt for standard transfers. However, it does involve a waiting period of a few business days for the funds to clear.

Using a Debit Card as an Intermediary

Similar to using a bank account, you can use a debit card to transfer funds between Cash App and PayPal. This method is generally faster but may incur fees.

- Link Your Debit Card to Cash App: Open Cash App, tap the profile icon, select “Linked Banks,” and link your debit card.

- Transfer Funds from Cash App to Your Debit Card: Cash out funds from Cash App to your linked debit card. This usually incurs a fee, but the funds are available almost instantly.

- Link the Same Debit Card to PayPal: Log in to PayPal, go to “Wallet,” and link the same debit card.

- Add Funds to PayPal Using Your Debit Card: In PayPal, go to “Wallet,” click “Add Money,” and use your linked debit card to add funds to your PayPal balance.

This method is quicker than using a bank account, but be mindful of the potential fees charged by both Cash App and PayPal for debit card transactions.

Using a Third-Party Payment Service (Potentially)

While less common, some third-party payment services may offer a way to bridge the gap between Cash App and PayPal. However, it’s crucial to thoroughly research and vet any such service before using it. Ensure the service is reputable, secure, and transparent about its fees and transaction processes. As of the current date, there are very few (if any) reputable third-party services that directly facilitate this type of transfer. Be extremely cautious of any service claiming to do so, as it could be a scam. Always prioritize security and due diligence when dealing with financial transactions online.

Considerations and Potential Issues

When transferring money between Cash App and PayPal using these alternative methods, there are several factors to consider:

- Fees: Both Cash App and PayPal may charge fees for certain types of transactions, such as instant transfers or debit card payments. Be sure to check the fee structure before initiating any transfer.

- Transfer Limits: Both platforms have daily and weekly transfer limits. Ensure that the amount you want to transfer falls within these limits.

- Security: Always prioritize security when transferring money online. Use strong passwords, enable two-factor authentication, and be wary of phishing scams.

- Timing: Standard bank transfers can take 1-3 business days to clear. If you need the money urgently, consider using a debit card transfer, but be prepared to pay a fee.

- Verification: Ensure that your Cash App and PayPal accounts are fully verified to avoid any delays or restrictions on your transfers.

Tips for Smooth Transfers

To ensure a smooth and hassle-free transfer experience, consider the following tips:

- Plan Ahead: If you know you’ll need to transfer money between Cash App and PayPal, plan ahead to avoid any last-minute rushes or delays.

- Double-Check Account Details: Before initiating any transfer, double-check that you’ve entered the correct bank account or debit card details.

- Monitor Your Accounts: Keep a close eye on your Cash App and PayPal accounts to track your transfers and ensure that the funds are credited correctly.

- Contact Customer Support: If you encounter any issues during the transfer process, don’t hesitate to contact Cash App or PayPal customer support for assistance.

Cash App to PayPal: The Future of Transfers

While there’s no direct way to send money from Cash App to PayPal currently, the financial technology landscape is constantly evolving. It’s possible that in the future, these platforms may introduce new features or partnerships that facilitate seamless transfers between them. However, for now, the alternative methods outlined above provide a practical solution for moving your money between these two popular platforms. [See also: How to Link a Bank Account to Cash App] [See also: PayPal Alternatives for Online Payments]

The demand for interoperability between different payment platforms is growing, driven by consumer expectations for convenience and flexibility. As the digital payment space becomes more crowded, platforms may be compelled to collaborate or integrate their systems to remain competitive. Until then, understanding the existing workarounds and potential challenges is crucial for managing your finances effectively. Remember to prioritize security, plan ahead, and always double-check your account details to ensure a smooth and successful transfer.

In conclusion, while directly sending funds from Cash App to PayPal remains impossible due to competitive and technical constraints, using a linked bank account or debit card offers a reliable workaround. By understanding the steps involved, potential fees, and security considerations, you can navigate these transfers effectively. Keep an eye on future developments in the fintech space, as the landscape is constantly changing, and new solutions may emerge to bridge the gap between these popular payment platforms. Mastering these techniques will enable you to efficiently manage your funds across various platforms. The key is to stay informed and adaptable in the ever-evolving world of digital finance.