Cigna Stock: A Comprehensive Analysis for Investors

Cigna stock (CI) has been a subject of keen interest among investors, analysts, and market watchers. As a leading global health service company, Cigna’s performance is influenced by a complex interplay of factors, including healthcare policy changes, market trends, and company-specific strategies. This article provides a comprehensive analysis of Cigna stock, examining its historical performance, current valuation, growth prospects, and potential risks. Understanding these elements is crucial for investors considering adding CI to their portfolios.

Cigna’s Business Overview

Cigna operates through several segments, including Cigna Healthcare, Evernorth, and Corporate and Other. Cigna Healthcare provides medical, pharmacy, behavioral, dental, and vision benefits to individuals, families, and employers. Evernorth, formed through the combination of Express Scripts and other health services businesses, offers pharmacy benefits management, specialty pharmacy services, and care solutions. The Corporate and Other segment includes interest income and expense, as well as certain other activities.

Cigna stock‘s value is inherently tied to the overall health of the healthcare industry. Factors such as government regulations, technological advancements, and demographic shifts all play a role in shaping the company’s financial performance.

Historical Performance of Cigna Stock

Reviewing the historical performance of Cigna stock provides valuable insights into its volatility, growth trajectory, and ability to generate returns for investors. Over the past decade, Cigna has generally delivered strong returns, outperforming many of its peers and the broader market indices. This performance has been driven by a combination of organic growth, strategic acquisitions, and effective cost management.

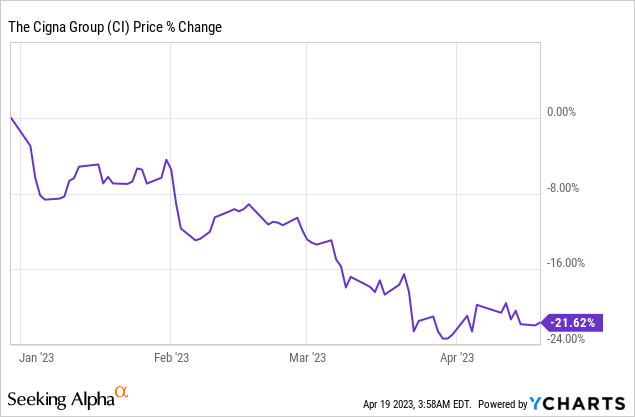

However, like any stock, Cigna stock has experienced periods of volatility, often linked to broader market downturns or industry-specific challenges. Analyzing these periods can help investors understand the potential risks associated with investing in CI and develop strategies to mitigate those risks. [See also: Healthcare Industry Trends to Watch]

Current Valuation of Cigna Stock

Assessing the current valuation of Cigna stock is essential for determining whether it is fairly priced relative to its earnings, assets, and growth prospects. Common valuation metrics include the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. Comparing these metrics to those of Cigna’s peers and the industry average can provide valuable context.

Analysts often use discounted cash flow (DCF) models to estimate the intrinsic value of Cigna stock. These models take into account the company’s projected future cash flows, discounted back to their present value. The accuracy of these models depends heavily on the assumptions used, such as growth rates, discount rates, and terminal values.

Currently, Cigna stock is trading at a P/E ratio that is slightly below the industry average, suggesting that it may be undervalued. However, investors should consider other factors, such as the company’s debt levels and growth prospects, before making any investment decisions.

Growth Prospects for Cigna

The growth prospects for Cigna stock are closely tied to the company’s ability to expand its market share, innovate its products and services, and capitalize on emerging trends in the healthcare industry. Cigna has been actively investing in new technologies and partnerships to enhance its offerings and improve customer experience.

One key growth driver for Cigna is its expansion into new markets, both domestically and internationally. The company has been focusing on growing its international business, particularly in emerging markets where there is a significant unmet need for healthcare services. [See also: Global Healthcare Market Outlook]

Another growth opportunity for Cigna lies in its ability to leverage its data analytics capabilities to improve healthcare outcomes and reduce costs. By analyzing vast amounts of data, Cigna can identify patterns and trends that can help it optimize care delivery and prevent costly medical events.

Potential Risks and Challenges

Investing in Cigna stock, like any investment, involves certain risks and challenges. One of the primary risks is the uncertainty surrounding healthcare policy. Changes in government regulations, such as the Affordable Care Act (ACA), can have a significant impact on Cigna’s business and financial performance.

Another risk is the increasing competition in the healthcare industry. Cigna faces competition from other large health insurers, as well as from smaller, more specialized players. To remain competitive, Cigna must continue to innovate and differentiate its offerings.

Furthermore, Cigna is subject to litigation and regulatory scrutiny. The company has been involved in various legal proceedings and investigations related to its business practices. These proceedings can be costly and time-consuming, and they can also damage the company’s reputation.

Cigna’s Financial Health

A thorough assessment of Cigna stock requires a close look at the company’s financial health. This includes analyzing its balance sheet, income statement, and cash flow statement. Key metrics to consider include revenue growth, profitability, debt levels, and cash flow generation.

Cigna has consistently generated strong revenue growth over the past several years, driven by its expansion into new markets and its ability to attract and retain customers. The company has also maintained healthy profit margins, thanks to its effective cost management and its focus on high-value services.

Cigna’s debt levels are relatively high, but the company has been actively working to reduce its debt burden. It has been using its strong cash flow to pay down debt and improve its financial flexibility.

Analyst Ratings and Recommendations

Analysts who cover Cigna stock provide valuable insights and recommendations to investors. These analysts conduct in-depth research on the company and its industry, and they issue ratings and price targets based on their analysis.

Currently, the majority of analysts have a positive rating on Cigna stock, with a consensus price target that is significantly above the current trading price. This suggests that analysts believe that the stock has significant upside potential.

However, investors should not rely solely on analyst ratings when making investment decisions. It is important to conduct your own research and consider your own investment objectives and risk tolerance.

Cigna Stock and Dividend Payments

Many investors consider dividend payments when evaluating Cigna stock. Cigna has a history of paying dividends to its shareholders, providing a steady stream of income. The dividend yield, which is the annual dividend payment divided by the stock price, is an important metric to consider.

Cigna’s dividend yield is currently in line with the industry average. The company has a track record of increasing its dividend payments over time, which is a positive sign for investors.

The Impact of Market Conditions on Cigna Stock

General market conditions can significantly influence the performance of Cigna stock. Economic downturns, rising interest rates, and geopolitical events can all impact investor sentiment and stock prices.

During periods of economic uncertainty, investors often flock to defensive stocks, such as healthcare stocks, which are considered to be less sensitive to economic fluctuations. This can lead to increased demand for Cigna stock and drive up its price.

Strategies for Investing in Cigna Stock

There are various strategies that investors can use when investing in Cigna stock. One common strategy is to buy and hold the stock for the long term, taking advantage of its growth potential and dividend payments.

Another strategy is to trade the stock actively, taking advantage of short-term price fluctuations. This strategy requires more time and effort, but it can potentially generate higher returns. [See also: Investing Strategies for Healthcare Stocks]

Investors should also consider diversifying their portfolios to reduce risk. By investing in a variety of different stocks and asset classes, investors can minimize the impact of any single investment on their overall portfolio.

Conclusion: Is Cigna Stock a Good Investment?

Cigna stock presents a compelling investment opportunity for those seeking exposure to the healthcare industry. The company’s strong financial performance, growth prospects, and dividend payments make it an attractive option for long-term investors. However, it’s crucial to acknowledge the potential risks and challenges, including healthcare policy uncertainties and increasing competition. By carefully analyzing these factors and conducting thorough research, investors can make informed decisions about whether to add CI to their portfolios. Understanding the nuances of Cigna stock is key to navigating the complexities of the healthcare investment landscape.